All Categories

Featured

Table of Contents

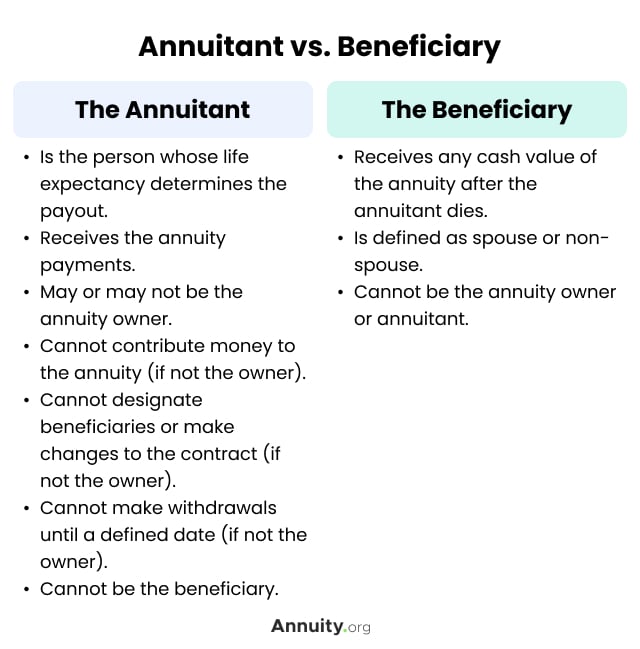

On the other hand, if a client needs to attend to an unique needs youngster who may not have the ability to manage their own cash, a trust can be included as a recipient, allowing the trustee to handle the distributions. The sort of beneficiary an annuity owner selects influences what the recipient can do with their acquired annuity and how the proceeds will be exhausted.

Lots of contracts permit a spouse to identify what to do with the annuity after the owner passes away. A spouse can change the annuity contract into their name, presuming all regulations and rights to the initial agreement and postponing instant tax repercussions (Fixed-term annuities). They can gather all staying settlements and any kind of survivor benefit and select recipients

When a partner comes to be the annuitant, the partner takes over the stream of payments. Joint and survivor annuities additionally enable a called recipient to take over the contract in a stream of settlements, instead than a lump sum.

A non-spouse can just access the marked funds from the annuity owner's first arrangement. Annuity owners can pick to assign a count on as their beneficiary.

What types of Immediate Annuities are available?

These differences mark which beneficiary will certainly receive the whole survivor benefit. If the annuity owner or annuitant dies and the main recipient is still to life, the main beneficiary obtains the fatality advantage. Nonetheless, if the primary beneficiary predeceases the annuity owner or annuitant, the fatality advantage will certainly go to the contingent annuitant when the proprietor or annuitant dies.

The owner can transform recipients any time, as long as the contract does not require an irrevocable beneficiary to be called. According to expert contributor, Aamir M. Chalisa, "it is necessary to understand the relevance of marking a recipient, as choosing the incorrect beneficiary can have major repercussions. A number of our customers pick to name their minor youngsters as recipients, frequently as the key recipients in the absence of a partner.

Owners that are married ought to not assume their annuity immediately passes to their partner. When choosing a recipient, think about factors such as your connection with the person, their age and how acquiring your annuity might affect their economic scenario.

The recipient's partnership to the annuitant generally figures out the rules they comply with. A spousal recipient has even more options for dealing with an inherited annuity and is treated even more leniently with tax than a non-spouse beneficiary, such as a kid or other family member. Expect the proprietor does determine to name a child or grandchild as a recipient to their annuity

How can an Fixed Vs Variable Annuities protect my retirement?

In estate preparation, a per stirpes classification specifies that, needs to your recipient die prior to you do, the beneficiary's offspring (kids, grandchildren, et cetera) will obtain the survivor benefit. Get in touch with an annuity professional. After you have actually chosen and named your recipient or beneficiaries, you must continue to assess your options a minimum of annually.

Maintaining your designations up to day can guarantee that your annuity will certainly be taken care of according to your dreams ought to you die unexpectedly. Besides a yearly review, significant life events can trigger annuity proprietors to reevaluate at their beneficiary options. "Somebody might intend to update the beneficiary classification on their annuity if their life conditions change, such as marrying or separated, having kids, or experiencing a death in the household," Mark Stewart, Certified Public Accountant at Action By Action Organization, informed To alter your recipient designation, you have to connect to the broker or representative that handles your contract or the annuity supplier itself.

How do I cancel my Tax-deferred Annuities?

Similar to any kind of financial product, seeking the help of a monetary expert can be helpful. A monetary coordinator can assist you via annuity monitoring procedures, including the methods for upgrading your agreement's recipient. If no beneficiary is named, the payment of an annuity's death advantage mosts likely to the estate of the annuity holder.

To make Wealthtender free for visitors, we gain money from marketers, consisting of economic experts and companies that pay to be featured. This produces a problem of rate of interest when we favor their promotion over others. Wealthtender is not a client of these monetary solutions providers.

As an author, it is just one of the finest praises you can offer me. And though I truly appreciate any of you spending some of your hectic days reviewing what I compose, slapping for my post, and/or leaving praise in a comment, asking me to cover a subject for you truly makes my day.

It's you claiming you trust me to cover a topic that is necessary for you, and that you're confident I 'd do so much better than what you can currently locate on the Web. Pretty stimulating stuff, and a duty I don't take likely. If I'm not aware of the topic, I research it on-line and/or with calls that understand even more about it than I do.

How do I get started with an Fixed Indexed Annuities?

Are annuities a valid referral, a wise move to safeguard guaranteed income for life? In the most basic terms, an annuity is an insurance item (that only accredited agents might market) that guarantees you regular monthly settlements.

This usually applies to variable annuities. The more bikers you tack on, and the much less threat you're ready to take, the reduced the settlements you need to expect to get for a given costs.

What is the best way to compare Annuity Withdrawal Options plans?

Annuities chose appropriately are the appropriate selection for some individuals in some circumstances., and after that number out if any type of annuity alternative offers enough benefits to validate the costs. I used the calculator on 5/26/2022 to see what an instant annuity could payment for a single costs of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Decoding Variable Vs Fixed Annuity Key Insights on Variable Annuity Vs Fixed Annuity Breaking Down the Basics of Investment Plans Benefits of Variable Vs Fixed Annuities Why Choosing the Right Financi

Highlighting Fixed Annuity Or Variable Annuity Everything You Need to Know About Financial Strategies Defining Variable Vs Fixed Annuities Features of Variable Annuity Vs Fixed Annuity Why Fixed Inter

Highlighting the Key Features of Long-Term Investments A Closer Look at Fixed Vs Variable Annuities Defining the Right Financial Strategy Features of Smart Investment Choices Why Choosing the Right Fi

More

Latest Posts